Introduction

Is Uzbekistan buying JF-17 from Pakistan? To understand it, let’s have a short introduction to this fighter jet.

The JF-17 Thunder is a jointly developed fighter jet from Pakistan and China, meant to provide an affordable alternative to expensive Western jets.

It is marketed as “ an advanced, lightweight, all-weather, day/night multi-role fighter aircraft with excellent air-to-air and air-to-surface combat capabilities.”

The 58%–42% Pakistani-Chinese airframe carries diverse ordnance

- Air-to-air

- Air-to-surface

- Anti-ship missiles

- Bombs

- 23 mm cannon

- and can reach roughly Mach 1.6

By early 2025, Pakistan’s Air Force operated over 150 JF-17s (across Block I, II, and the latest Block III versions). Western news agencies note that “the aircraft is co-produced by the Pakistan Aeronautical Complex and developed jointly with China” and is “capable of undertaking a wide array of combat missions, providing contemporary airpower employment options.”

Uzbekistan’s Defense Challenges and Modernization Drive

At the same time, Uzbekistan’s defense strategy has shifted. With a modest defense budget (about $1.7 billion in 2023), Tashkent cannot easily afford top-tier Western jets, and it is eager to diversify away from sole reliance on Russia. China has already started supplying Uzbekistan with air-defense systems (like the FM-90 short-range SAM) and co-hosting defense industry events with Uzbek partners.

In short, Uzbekistan wants modern capabilities but within budget and without over-dependence on any single supplier. Its interest in new-generation fighter jets comes at a time when Russia’s ability to export cutting-edge aircraft (like Su-30SMs) is constrained by its war economy and when Western sales (F-16s, Rafales, etc.) may carry political strings or high costs.

Why the JF-17 Catches Tashkent’s Eye

Several factors make the JF-17 attractive for Uzbekistan.

1. cost-effectiveness:

Unlike fighter jets from the U.S. or Europe (which can exceed $100 million per jet), the JF-17 is relatively affordable. Regional analysts note that Chinese estimates for advanced jets range “between $70–85 million per unit” for models like the JF-17C

2. Availablity and Support:

China and Pakistan are keen to export the jet and reportedly offer incentives such as flexible financing, joint training, and even technology transfer. Beijing’s outreach reportedly includes favorable maintenance packages that could cut life-cycle costs substantially.

3. Less Dependence On Russia:

Strategically, acquiring the JF-17 would signal a diversification of Uzbekistan’s arms suppliers. It would reduce dependence on Russia at a time when Moscow is preoccupied with Ukraine and under sanctions.

4. New Partnerships:

It would deepen ties with China (and indirectly Pakistan), reflecting Uzbekistan’s broader policy of building new partnerships.

A recent Eurasianet report notes that Tashkent was even weighing French Rafales, but that “Chinese officials pressed their sales pitch” and that “JF-17s are reportedly less expensive to maintain than Rafale fighters and require less extensive pilot training.”

In short, the JF-17 offers Uzbekistan a modern fighter with fewer “political baggage” issues than Western jets and more advanced tech than older Russian designs, all at a lower price point.

Alternatives on the Table: Why Not Others?

Uzbekistan has explored other options, but each has drawbacks.

1. Russian Jets:

Proposals for Su-30SMs or even MiG-35s have been discussed in the past, but the Ukraine war bottlenecks and high costs are hurdles. The Su-30SM is a capable fighter, but at roughly $70+ million per unit it is expensive, and Russia’s export line is slowed by domestic demands. Moreover, maintenance of Russian planes (especially with parts shortages) can drive up lifetime costs. For example, a Russian Su-30SM might cost $50–60M to buy, but total expenses “could increase by up to 50% once training and maintenance are factored in,” according to defense analysts.

2. US F-16s:

Uzbekistan once expressed interest in F-16s, but these have proved politically or financially challenging. Washington has been reluctant to deepen military ties after past human rights concerns, and an F-16 deal would carry U.S. oversight

3. French Rafales:

France engaged Uzbekistan on Rafales (Uzbek media reported discussions of 24 Rafales, for instance), but the French fighters are extremely pricey and come with EU/NATO alignment issues. As one report put it, the Rafale “is cutting-edge but politically sensitive,” especially outside Europe.

4. Other Western Jets:

Other Western and allied jets like the Swedish Gripen or South Korean FA-50 have been mentioned in global defense circles, but none have moved beyond speculation. In short, Western aircraft are largely off the table for Uzbekistan today due to cost, politics, or delivery timelines.

5. Chinese Alternatives:

China has other fighter options, such as the larger J-10C (comparable to an F-16) or its new J-35 stealth fighter. These have been floated as options, but each is a bigger step. The J-10C might even cost more than a JF-17 (and is unlikely to see export until the very late 2020s), and the J-35 is not yet fully in service anywhere. By contrast, the Block III JF-17 is already operational with Pakistan and now being exported. For Uzbekistan, the JF-17 Block III offers an optimal middle ground: more capable than legacy MiGs/Su-27s and far cheaper and less restrictive than Western 4.5-gen fighters, without the high entry bar of full fifth-generation jets.

The Potential Deal: Scope and Timeline

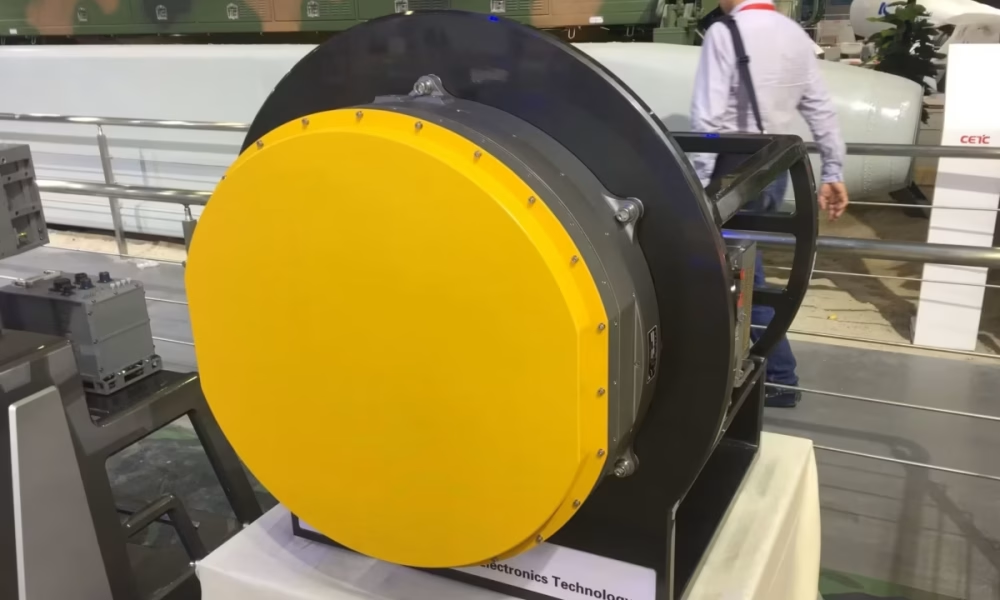

Details of any Uzbek-Pak/Chinese deal remain unannounced, but analysts speculate on numbers and timing. Reports suggest Tashkent is eyeing the Block III variant of the JF-17, which includes modern upgrades (AESA radar, advanced missiles, improved avionics). While exact figures aren’t public, industry sources have floated orders of a few dozen jets.

For context, Pakistan itself can produce about 20 JF-17s per year, so an Uzbek order could be fulfilled over a few years once signed. A squadron (perhaps 12–24 jets) would be enough to replace Uzbekistan’s remaining MiG-29s and form a significant new force.

On budget, such a purchase would be a major chunk of Uzbekistan’s defense spending. Even at, say, $70 million per jet, a 12-aircraft order would approach $840 million, not including weapons and training. But financing options may spread costs. Commentators note that Chinese offers often include favorable payment plans, with service and training deals bundled in.

If a deal is struck in 2025, delivery might begin by 2026–2027, as Pakistan is already building Block III jets for the PAF and other customers. In any case, the first Uzbek JF-17s could arrive within a few years, allowing pilots and ground crews to train on simulators and flight tests soon after ordering.

JF-17 in Service: Global Users and Lessons

Only a handful of countries fly the JF-17 today, and their experiences are mixed. Pakistan is the lead user, having fielded the jet since 2010. The PAF praises the JF-17 as a main pivot and is adopting Block III variants with Chinese AESA radar and PL-15s. Other operators include Nigeria, Myanmar, and most recently Azerbaijan. (A deal with Iraq was rumored but later denied by Iraqi officials.)

Pakistan Air Force

As the developer, Pakistan operates the largest fleet (~150+ jets). The JF-17 has largely met Pakistan’s needs for a versatile fighter at a lower cost than more advanced options. They are also upgrading their Block I & II JF-17s to Block III. Pakistani pilots routinely use it for both air defense and ground-attack roles.

Nigerian Air Force

In 2021, Pakistan delivered three JF-17s to Nigeria as part of a military aid package. Nigerian officials welcomed the jets as a step up for their Air Force. Defense News quotes analysts noting Nigeria’s chronic readiness problems and emphasizing that the JF-17’s ease of maintenance is a key benefit. Nigerian leaders hope the JF-17, with its precision-guided weapons and day/night pods, will bolster counterterrorism operations.

Myanmar Air Force

Myanmar has 13 JF-17s currently in service, and 3 more are on order, but they have experienced a bit of trouble. Around 2018–2021, Pakistan supplied a small number of JF-17s to the Myanmar Air Force. But reports emerged that the junta later found these jets “unfit for operations,” citing malfunctions and structural flaws. Pakistan has since been in talks to deliver newer versions, but the episode has made some analysts cautious: it serves as a reminder that JF-17 logistics and quality control can be challenging without close support.

Azerbaijan Air Force

In September 2024, Pakistan announced a contract to sell JF-17 Block III jets to Azerbaijan. Azerbaijan has ordered 16 JF-17s Block III, and this would make Azerbaijan the third export customer. Deliveries are expected in 2025–26, after Pakistan completes the batch. Since Azerbaijan is in an ongoing security competition in the Caucasus, the addition of JF-17s there underscores the jet’s growing market: local analysts see it as “filling an expanding market niche” for mid-tier air forces.

In summary, the JF-17 is in service across varied environments. Pakistan’s adoption underscores that it can work as a front-line fighter.

Conclusion

For Uzbekistan’s air force, acquiring JF-17s would represent a positive leap. They would replace obsolescent jets, enhance air defense and strike capabilities, and open doors to Chinese-Pakistani technical support. In sum, analysts agree this is likely “a positive step for Uzbekistan’s air force modernization and regional defense posture.” For a country seeking 21st-century capability on a budget, the JF-17 may just fit the bill—giving Uzbekistan modern fighters that are “lightweight, all-weather, multi-role” by design and helping to secure its skies in a complex neighborhood.

Such a move would reflect Tashkent’s desire to modernize quickly and affordably and to assert strategic independence from Moscow. It may prompt neighbors (Kazakhstan, Turkmenistan, Kyrgyzstan) to accelerate their own defense diversification, especially as they observe China’s willingness to sell high-end systems with financing and training.